1. Introduction to Tesla car insurance

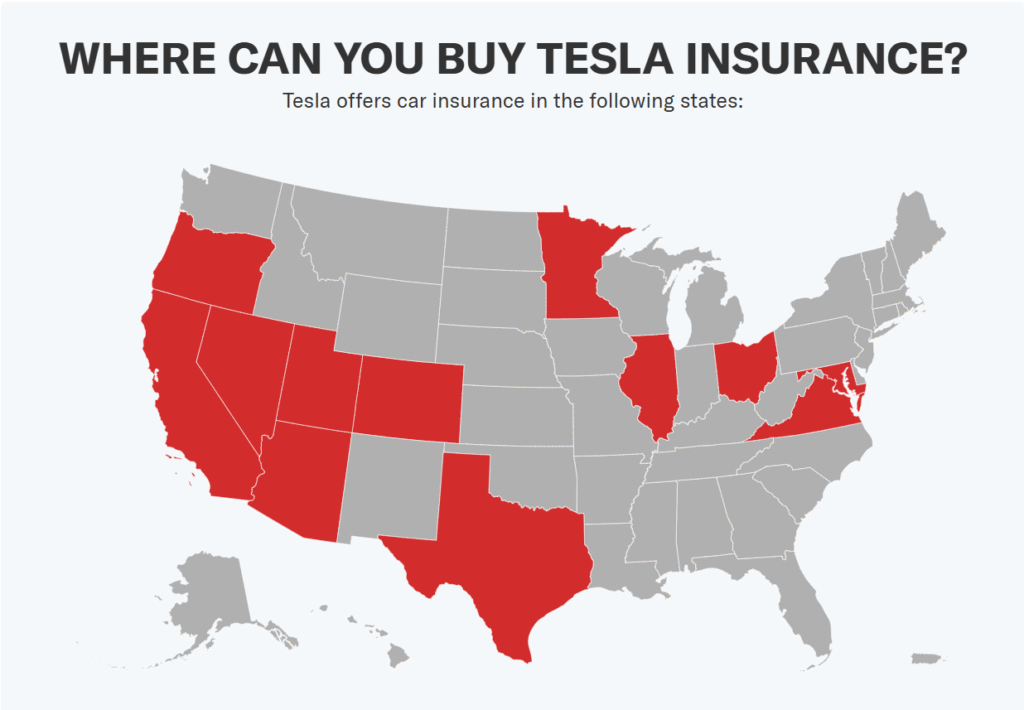

As a pioneer in the electric vehicle industry, Tesla not only leads the trend in vehicle design and technology, but also extends its innovative spirit to the field of car insurance. Tesla car insurance adopts a pricing model based on driving behavior, which is different from the traditional pricing system that relies on factors such as age, gender, and driving history. By monitoring driving habits in real time, Tesla provides car owners with more personalized and incentive insurance plans. The service currently covers 12 states in the United States, and plans to continue to expand in the future.

2. Insurance pricing mechanism and safety score

The core of Tesla car insurance lies in the “Safety Score” system, which comprehensively analyzes seven driving behavior indicators:

- Sudden braking

- Sharp turns

- Following distance

- Speeding

- Night driving

- Number of forced exits of the autopilot system

- Driving without a seat belt

This score directly affects the premium – safe drivers can enjoy lower premiums, while bad driving habits may lead to higher premiums. It is worth noting that due to regulatory restrictions, California will not use safety scores for pricing, but only as a reference for driving education.

In addition, insurance costs are also affected by factors such as vehicle model, location, mileage and selected coverage. All Tesla models can be insured, including Model S, Model 3, Model X, Model Y and Cybertruck.

3. Coverage and Service Features

Tesla Auto Insurance provides standard liability insurance that complies with state regulations, and also covers a variety of additional protection options:

- Liability Insurance: Covers personal injury and property damage liability

- Collision and Full Coverage: Vehicle accident and non-collision damage protection

- Uninsured/Underinsured Motorist Protection

- Medical Payment and Personal Injury Protection

- Roadside Assistance Service

- Rental Fee Reimbursement

- Glass Breakage Protection

- Gap Insurance: Pays the difference in loan balance when the vehicle is totally lost

Some states also offer the option of purchasing an “Autopilot Protection Package” that covers specific risks such as electronic key replacement and wall charger damage.

4. Advantages and Disadvantages Analysis

| Advantages | Disadvantages |

|---|---|

| Driving behavior-based pricing to encourage safe driving | Limited coverage in 12 states |

| Diverse protection options to meet different needs | Only provides insurance for Tesla owners (except California) |

| Seamless integration with vehicle apps, convenient claims and management | Mainly contacted through apps, lack of manual customer service support |

| Provide additional services such as roadside assistance and rental car compensation | Lack of third-party customer satisfaction rating data |

5. Cost Overview

The average premium for Tesla auto insurance is about $350 per month, about $4,200 per year, which is significantly higher than the average auto insurance level in the United States (about $1,800/year). The cost difference is mainly due to the high maintenance costs and advanced materials of Tesla vehicles. The premiums of different models vary significantly: Model 3 is the most economical, with an average annual cost of about $2,965; Model X has a higher maintenance cost, with an average annual cost of about $4,780.

The owner’s driving performance, place of residence, and selected coverage will affect the final premium. Tesla uses a safety scoring mechanism to provide premium discounts for excellent drivers, and some states (such as Texas and Arizona) also offer exclusive discounts for using the autopilot assist function.

6. User Experience and Market Evaluation

Tesla insurance is popular with some car owners due to its innovative pricing model and deep integration with the vehicle. Users report that the claims process is relatively smooth and that the policy can be easily managed through the App. However, the limited service area and lack of traditional customer service channels have become pain points for some users. In addition, the high premiums also prompt car owners to make multiple comparisons when making choices.

Tesla car insurance provides a unique insurance experience with its unique driving behavior pricing system and rich coverage options. It not only encourages safe driving, but also achieves more accurate risk assessment through technical means. Although the coverage is limited and the premiums are relatively high, this innovative insurance solution is undoubtedly a choice worth considering for Tesla owners.

In the future, as Tesla’s insurance business expands and its services improve, its position in the auto insurance market is expected to further enhance, bringing electric car owners a more personalized and technological protection experience.