Hilton Hotel Group and American Express continue to deepen their cooperation and launched a series of upgraded Hilton Honors co-branded credit cards in 2025, equipped with the highest welcome bonus in history and rich travel benefits, aiming to bring more excellent hotel experience and consumption feedback to loyal users. This article will structurally analyze the core highlights, reward mechanisms and applicable groups of these credit cards to help you find the one that suits you best among many options.

1. Hilton Honors Credit Card Family Overview

The credit cards that Hilton and Amex cooperate on are mainly divided into four personal cards and one business card, ranging from basic cards with no annual fee to high-end flagship cards, to meet the needs of different users:

| Card Name | Annual Fee | Welcome Reward | Main Benefits | Applicable Group |

|---|---|---|---|---|

| Hilton Honors American Express Card | $0 | 100,000 points + $100 bill deduction | 7 times points hotel consumption, 5 times dining and supermarket gas, free Hilton Silver Card | Entry-level users, pursuing zero annual fee and basic rewards |

| Hilton Honors American Express Surpass® Card | $150 | 165,000 points | Hilton Gold Card, free night reward, up to $200 bill deduction | Moderate travelers, pursuing additional benefits |

| Hilton Honors American Express Aspire Card | $550 | 175,000 points | Hilton Diamond Card, $400 Resort Credit, Airport VIP Lounge | High-end travelers, seeking luxury experience |

| Hilton Honors American Express Business Card | $195 | 175,000 points | Hilton Gold Card, $240 bill credit, business-exclusive benefits | Corporate users, frequent business travel |

All cards offer the opportunity to earn Hilton Honors points through daily consumption, which can be redeemed for free nights, upgraded services and other travel benefits.

2. Welcome bonus and consumption bonus details

1. Welcome bonus

The 2025 limited-time offer has increased the welcome bonus of each card:

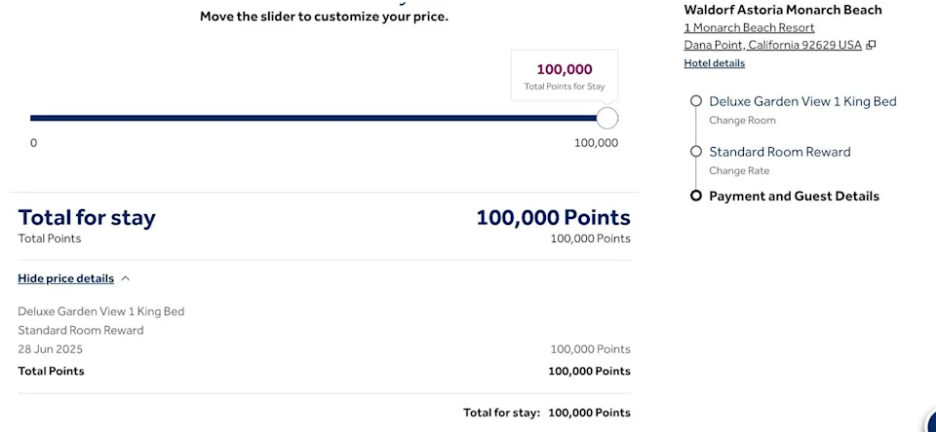

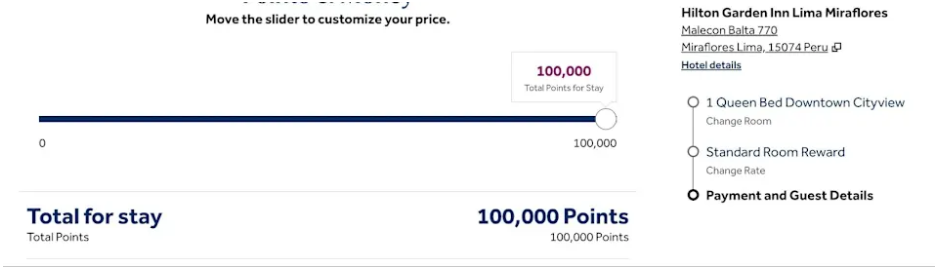

- Basic Hilton Honors Card: 100,000 points and $100 bill credit for spending $2,000.

- Surpass Card: 165,000 points for spending $3,000, including free night bonus.

- Aspire Card: 175,000 points for spending $6,000, plus discounts for top VIP lounges and resorts.

- Business Card: 150,000 points for spending $8,000, and 25,000 points for spending an additional $2,000.

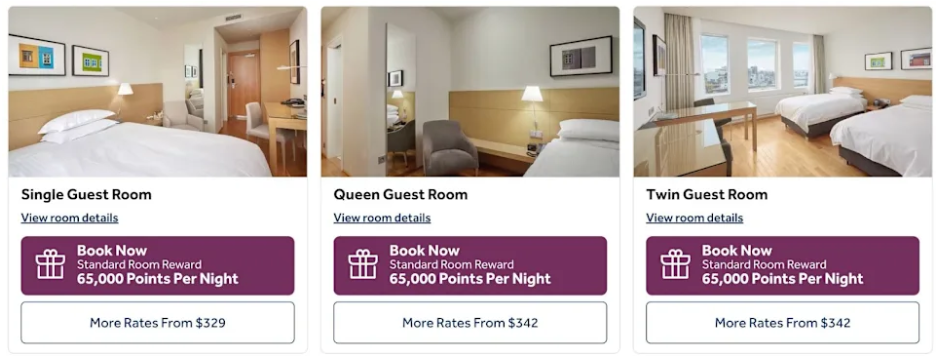

These points can be worth hundreds of dollars, enough to cover multiple nights of Hilton hotel stays.

2. Daily consumption rewards

- Hilton hotel consumption: 7x points for basic cards, 12x for Surpass and business cards, and 14x for Aspire cards.

- Dining, supermarkets, gas stations: 5x points (basic cards and Surpass cards).

- Other consumption: 3x points or 1x points.

- Annual consumption rewards: Some cards offer free accommodation vouchers or upgrade membership levels after reaching a certain amount of annual consumption.

3. Membership Level and Exclusive Benefits

- Hilton Silver Card: Automatically enjoyed by basic cardholders, providing priority registration and some upgrade privileges.

- Hilton Gold Card: Automatically enjoyed by Surpass and Business Cardholders, including free breakfast and room upgrade.

- Hilton Diamond Card: Exclusive to Aspire cardholders, enjoying top benefits such as executive lounge access and fifth night free.

In addition, some cards are equipped with multiple benefits such as annual resort consumption deductions, airport VIP lounge passes, travel insurance, etc., which greatly improve travel comfort.

4. How to choose the right Hilton credit card?

- Budget limited and seeking zero annual fee: Hilton Honors basic card is an ideal choice, with generous welcome rewards, suitable for occasional travelers.

- Frequent Hilton users: Surpass card provides more points and free nights, reasonable annual fee, and rich benefits.

- Pursue the ultimate experience: Although the annual fee of the Aspire card is high, the top membership level and VIP lounge service bring an unparalleled sense of dignity.

- Business travel needs: Business cards take into account both point rewards and business-exclusive services to help corporate travel management.

In 2025, Hilton and American Express have joined hands to bring consumers attractive credit card products, covering multi-level needs from entry-level to high-end. Whether it is a newcomer who applies for a hotel co-branded card for the first time or a senior traveler who pursues a luxury travel experience, they can find a solution that suits their needs in this product line. As a travel writer said: “The meaning of travel is not only the destination, but also every experience of being pampered by details during the journey.” Choosing a suitable Hilton credit card is the first step to start this wonderful journey.