1. What is the Loan-to-Value Ratio (LTV)?

The Loan-to-Value Ratio (LTV) is an important indicator to measure the relationship between the loan amount and the property value. It is calculated by dividing the loan amount by the assessed value or purchase price of the property to obtain a percentage that reflects the proportion of the loan to the property value.

For example, if the house value is $400,000 and the loan amount is $250,000, the LTV is:

[LTV = \frac{250,000}{400,000} \times 100\% = 62.5\%]

LTV is the core parameter for lenders to assess loan risks, which directly affects loan approval, interest rate level and whether mortgage insurance needs to be purchased.

2. How to calculate LTV?

The formula for calculating LTV is simple and clear:

[LTV = \frac{\text{Loan amount}}{\text{Property value}} \times 100\%]

- Loan amount: The amount of funds the borrower applies for from the lender.

- Property value: Usually the lower of the assessed value or the purchase price of the house.

Example:

- House purchase scenario: If the house price is $300,000, the down payment is $60,000, and the loan is $240,000, the LTV is 80%.

- Refinancing scenario: If the house is assessed at $350,000 and the existing loan balance is $280,000, the LTV is 80%.

3. The importance of LTV

1. Loan approval and risk assessment

Lenders judge the risk level of borrowers based on LTV. A lower LTV means that the borrower has invested more of his own funds, the loan risk is lower, and the loan is easier to approve.

2. Interest rate and loan cost

Lower LTV usually can get more favorable loan interest rate and reduce borrowing cost. On the contrary, high LTV loans are riskier, and interest rate and related fees are often higher.

3. Mortgage Insurance (PMI)

When LTV exceeds 80%, lenders usually require borrowers to purchase private mortgage insurance (PMI) to reduce the risk of loan default. PMI will increase the borrower’s monthly payment burden.

4. Loan amount limit

Lenders set limits on loan amounts and usually do not allow borrowers to loan amounts exceeding a certain percentage of the property value (such as 95%) to ensure loan safety.

4. Ideal LTV ratio

- 80% and below: Considered as ideal LTV, with low loan risk, favorable interest rate, and usually no PMI required.

- 80%-95%: Higher LTV, PMI may be required, and interest rate is higher.

- Above 95%: Extremely high risk, difficult to get loan approval, and significantly increased cost.

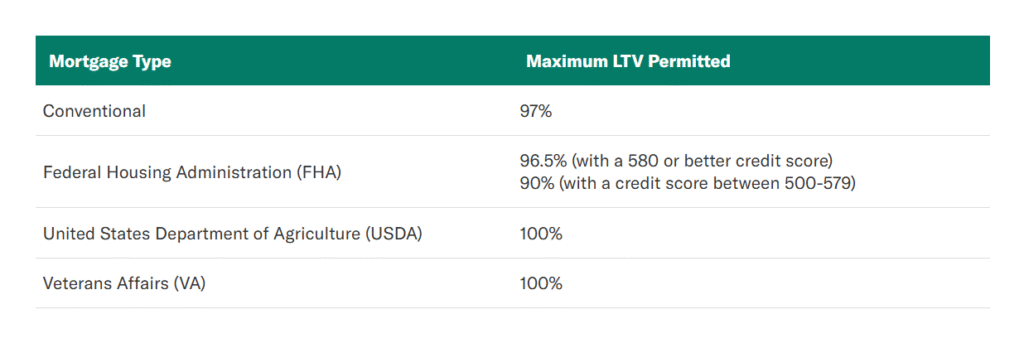

Some government-backed loan programs (such as FHA loans) allow up to 97% LTV, but with higher insurance costs.

5. The impact of LTV on homebuyers

- Down payment ratio: LTV is inversely proportional to the down payment. The higher the down payment, the lower the LTV. Reasonable planning of the down payment will help you get better loan terms.

- Loan selection: Understanding your own LTV will help you choose the right loan product and assess your repayment ability.

- Refinancing and HELOC: LTV also applies to refinancing and home equity lines of credit (HELOC), affecting the loan amount and interest rate.

Loan-to-value ratio (LTV) is a key indicator that cannot be ignored in the process of home purchase loans. It not only reflects the borrower’s risk level, but also directly affects the loan approval, interest rate and insurance requirements. Homebuyers should fully understand the calculation and significance of LTV, and reasonably plan the down payment and loan amount to obtain the best loan terms and reduce the cost of home purchase.