With the increasingly fierce competition in the global aviation industry, Delta Airlines and American Express have jointly launched a number of Delta SkyMiles co-branded credit cards, bringing unprecedented welcome bonuses. These credit cards are not only suitable for frequent travelers, but also provide users who occasionally take Delta flights with attractive points rewards and exclusive benefits. This article will systematically sort out the main benefits of these credit cards, the applicable population, and how to maximize these rewards.

1. Overview of Delta SkyMiles Credit Card Welcome Bonus

In 2025, Delta and American Express launched six personal and business SkyMiles credit cards, with up to 110,000 welcome bonus miles. Specifically including:

- Personal Credit Card:

- Gold Card: 80,000 miles for the first 6 months of spending $3,000

- Platinum Card: 90,000 miles for spending $6,000 in the first 6 months.

- Reserve Card: 110,000 miles for spending $12,000 in the first 6 months.

- Business Card:

- Gold Business Card: 90,000 miles for spending $3,000 in the first 6 months.

- Platinum Business Card: 100,000 miles for spending $6,000 in the first 6 months.

- Reserve Business Card: 110,000 miles for spending $12,000 in the first 6 months.

These rewards are the highest or tied for the highest level in history, significantly improving the travel value of cardholders.

2. Card Features and Benefits Analysis

1. Delta SkyMiles Gold American Express Card

- Annual Fee: No annual fee in the first year, $150 thereafter.

- Reward mechanism: 1 mile/USD for ordinary consumption, double miles for dining and supermarket consumption.

- Welcome bonus: 80,000 miles, with a low consumption threshold, suitable for users who occasionally fly Delta.

- Target group: Occasional travelers, focusing on basic rewards and low thresholds.

2. Delta SkyMiles Platinum American Express Card

- Annual fee: $350.

- Reward mechanism: 3 miles/USD for Delta consumption, 2 miles/USD for dining and supermarkets, and 1 mile/USD for other purchases.

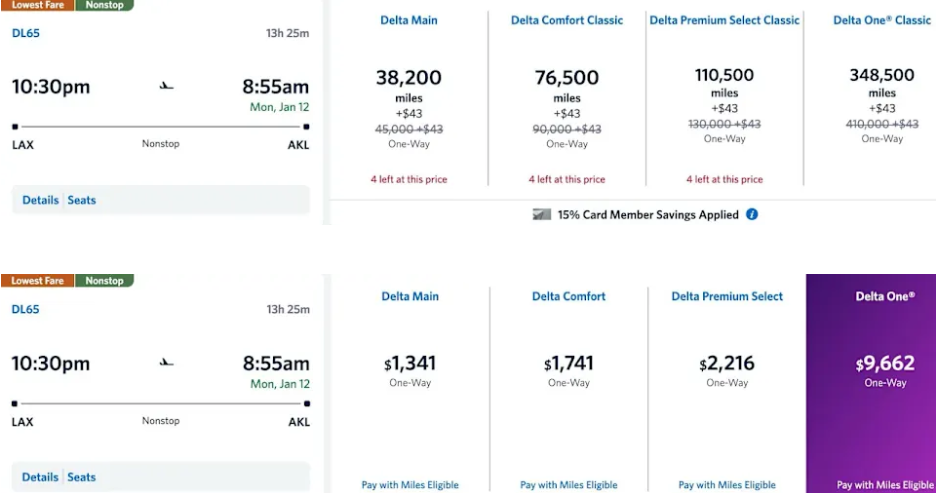

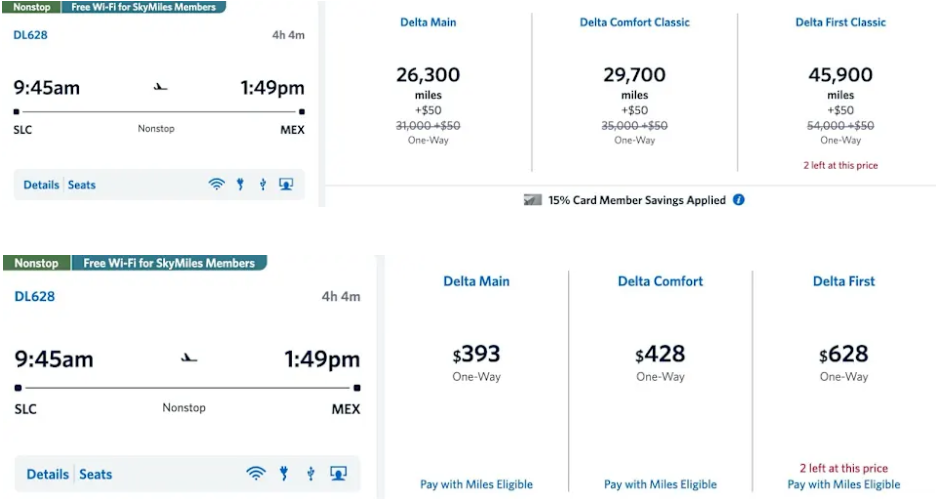

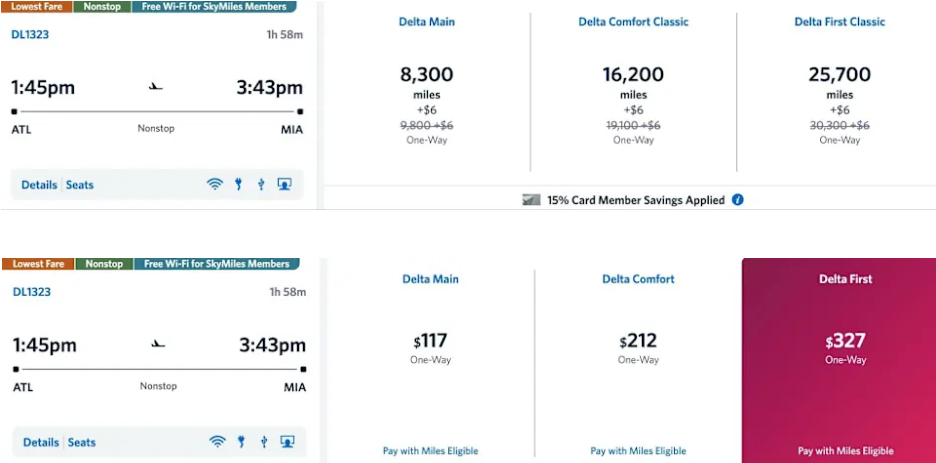

- Additional benefits: 15% mileage redemption discount, free checked baggage, hotel credit.

- Welcome bonus: 90,000 miles, with a moderate consumption threshold.

- Target group: Frequent travelers, users who seek more travel benefits.

3. Delta SkyMiles Reserve American Express Card

- Annual fee: $650.

- Reward mechanism: 3 miles/USD for Delta consumption, 1 mile/USD for other consumption.

- Exclusive benefits: Free admission to Delta Sky Club airport VIP lounge, annual companion air ticket (taxes and fees required), priority boarding, etc.

- Welcome bonus: 110,000 miles, with a high consumption threshold.

- Applicable people: High-frequency Delta travelers, users who pursue top travel experience and distinguished service.

3. Unique advantages of the business version card

The welcome bonus of the business version card is similar to that of the personal version, but it usually offers higher mileage rewards, which is suitable for business owners or business people who travel frequently. Business cards are also divided into three levels: Gold, Platinum and Reserve, to meet the needs of corporate users of different sizes and needs.

4. The value of the Delta SkyMiles credit card

- Mile value: According to Bankrate’s estimate, the average value of Delta SkyMiles is about 1.2 cents/mile.

- Bonus increase: This limited-time welcome bonus has increased its value by about $420 to $480 compared to the previous one, which is almost twice the usual bonus.

- Travel coverage: Delta routes cover more than 290 destinations around the world. Cardholders can redeem international and domestic flights with accumulated miles, greatly reducing travel costs.

5. How to choose a Delta credit card that suits you

When choosing a Delta SkyMiles credit card, you should weigh your personal travel frequency, spending habits and benefits needs:

- Occasional travelers: The Gold card has a lower spending threshold and annual fee, which is suitable for light travelers.

- Medium to high-frequency travelers: The Platinum card offers more rewards and travel benefits, which is suitable for users who frequently take Delta flights.

- Seekers of premium experience: The Reserve card is equipped with high-end services such as airport VIP lounges and companion tickets, which is suitable for users who pursue a luxurious travel experience.

In addition, business users can consider the corresponding business card version to meet the company’s travel needs[4][5].

VI. Practical suggestions and summary

- Apply in time: Since the welcome bonus is a limited-time offer, it is recommended that interested parties apply as soon as possible to avoid missing the opportunity.

- Plan consumption reasonably: Ensure that the consumption threshold is reached within the specified time to maximize the bonus benefits.

- Combined with personal needs: Compare the annual fees and benefits of each card and choose the card that best suits your travel and consumption habits.

As a banking expert said, the rational use of the benefits and rewards of the Delta SkyMiles credit card can significantly save travel expenses and improve the overall travel experience.

The 2025 Delta SkyMiles credit card welcome bonus is a rare high standard in the industry. Whether you are a novice or a veteran frequent flyer, you can find the one that suits you in this feast of discounts. Seize this opportunity to not only accumulate a lot of flight miles, but also enjoy the high-quality services and convenience brought by Delta Airlines. The excitement of travel starts with a credit card.