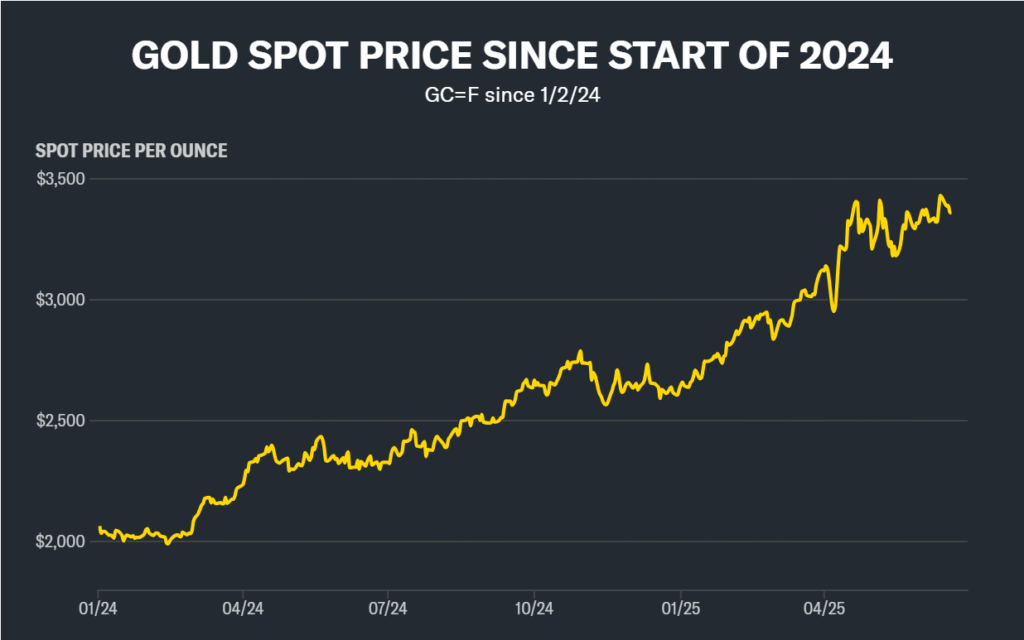

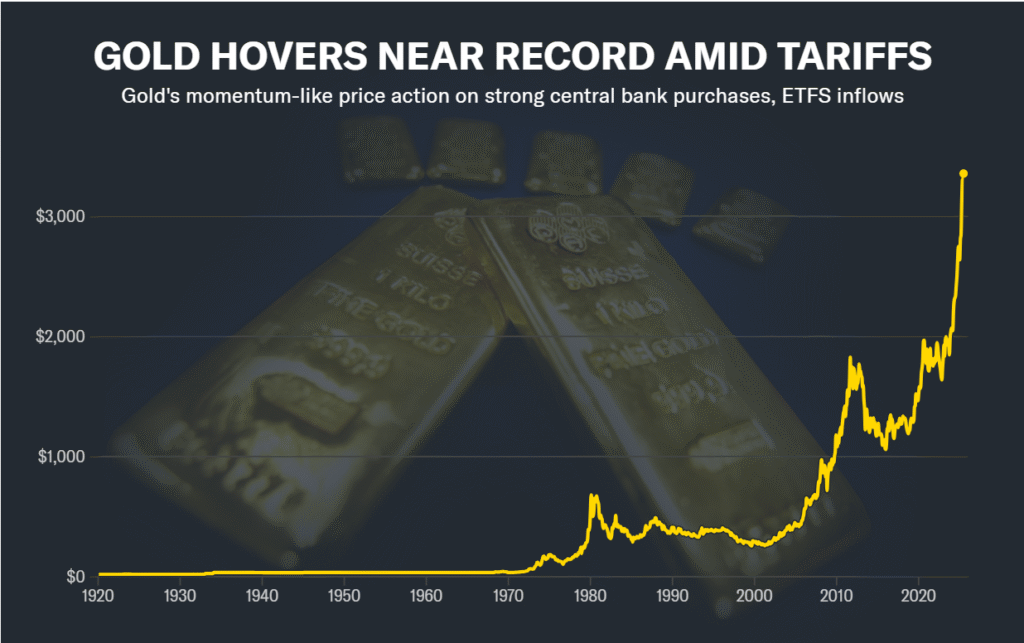

1. Gold price trend

On June 4, 2025, the global gold market showed a slight upward trend, with the spot gold price at about US$3,360 per ounce, up 0.2% from the previous trading day. In India, the price of 24K gold reached 9,917 Indian rupees per gram, 22K gold was about 9,090 Indian rupees, and 18K gold was 7,438 Indian rupees. Global economic uncertainty and geopolitical tensions continue to drive demand for gold as a safe-haven asset.

2. Market background and impact of economic data

The latest data from the United States showed that job vacancies increased in April, but the number of unemployed people climbed to a nine-month high, reflecting complex and contradictory signals in the labor market. Investors are closely watching the upcoming US non-farm payrolls report in the hope of gaining insight into the future interest rate policy direction of the Federal Reserve. If the employment data is strong, it may reduce market expectations for interest rate cuts, thereby exerting some pressure on gold prices.

In addition, the repeated trade frictions between China and the United States have also added uncertainty to the market, further pushing up the safe-haven demand for gold.

3. Technical analysis and price forecast

From a technical perspective, gold prices are currently holding key support levels, with buyers actively maintaining prices near the 21-day simple moving average and the 38.2% Fibonacci retracement level. If the price breaks through the resistance level of $3,377, gold is expected to rise further and challenge the historical high of $3,500. On the contrary, if it falls below the 50-day moving average of $3,262, it may test the 50% Fibonacci retracement support of $3,232.

Gold prices are fluctuating upward under the dual effects of economic data and geopolitical risks. Investors should continue to pay attention to US non-farm payrolls data and Fed policy dynamics to grasp the future direction of the gold market. Given the current complex and changing macroeconomic environment, gold is still an important safe-haven asset in the investment portfolio.