1. Introduction to Figo Pet Insurance

As a relatively new pet insurance brand in the US market, Figo stands out for its highly flexible protection plan and digital management platform. It supports pets of all ages and provides a variety of reimbursement ratios and deductible options to meet the personalized needs of different pet owners. Figo also cooperates with Costco to provide members with exclusive discounts to further improve the cost-effectiveness.

2. Coverage and Features

1. Coverage Content

- Full coverage of accidents and diseases: including hereditary diseases, chronic diseases, alternative therapies (such as acupuncture, physical therapy) and caesarean sections.

- Prescription drugs: covered to ensure continuity of treatment.

- Optional routine care plan: Some states offer additional health care options, covering preventive services such as vaccines and physical examinations.

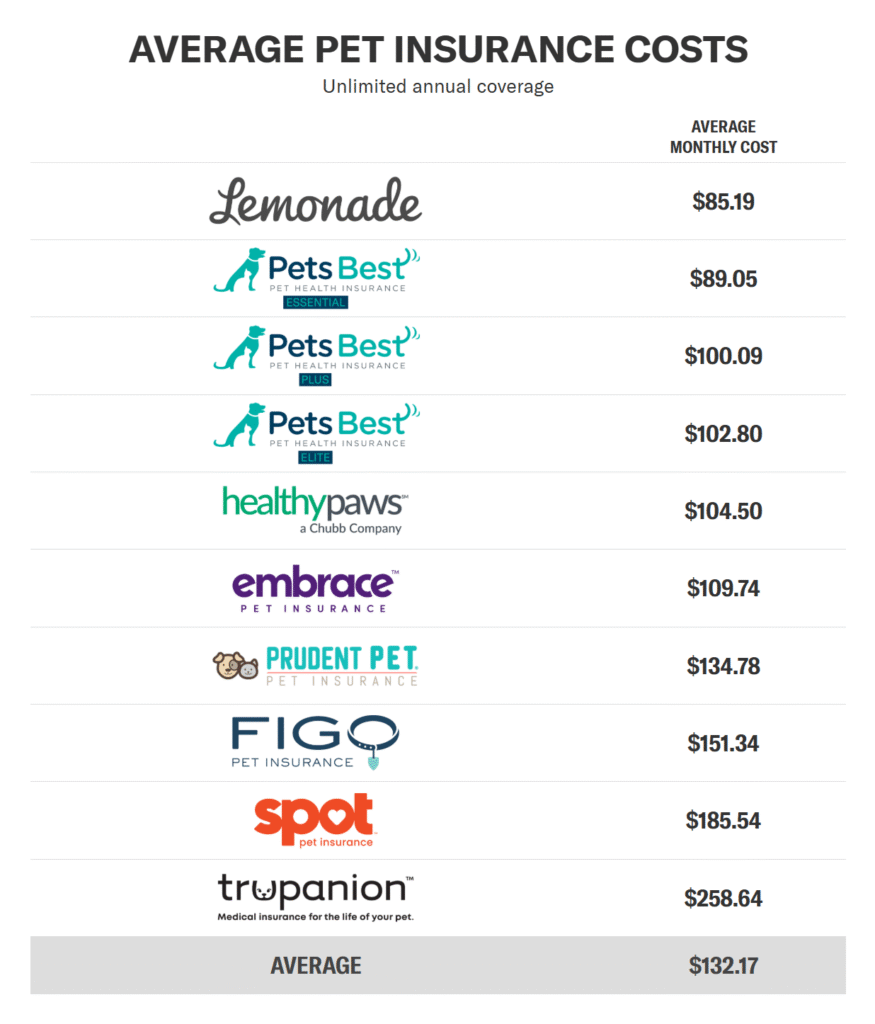

- No annual compensation limit: Provide pet owners with more peace of mind for long-term protection.

- Global protection: Pets are covered anywhere in the world.

2. Reimbursement and deductible

- Flexible reimbursement ratios, including 70%, 80%, 90% and even 100% options.

- Deductibles are calculated on an annual basis, and can be reduced by $50 per year without claims, up to zero.

- Accident-only simplified plans are not available, with more comprehensive coverage but relatively high premiums.

3. Digital service advantages

Figo has a feature-rich mobile app that supports:

- 24/7 online veterinary consultation to answer health questions at any time.

- Health reminder settings to help owners manage vaccination and physical examination time.

- Submit and track claims online, with an average claim processing time of about 3 days.

- Pre-approval of treatment costs to improve claims transparency and efficiency.

4. Price and preferential policies

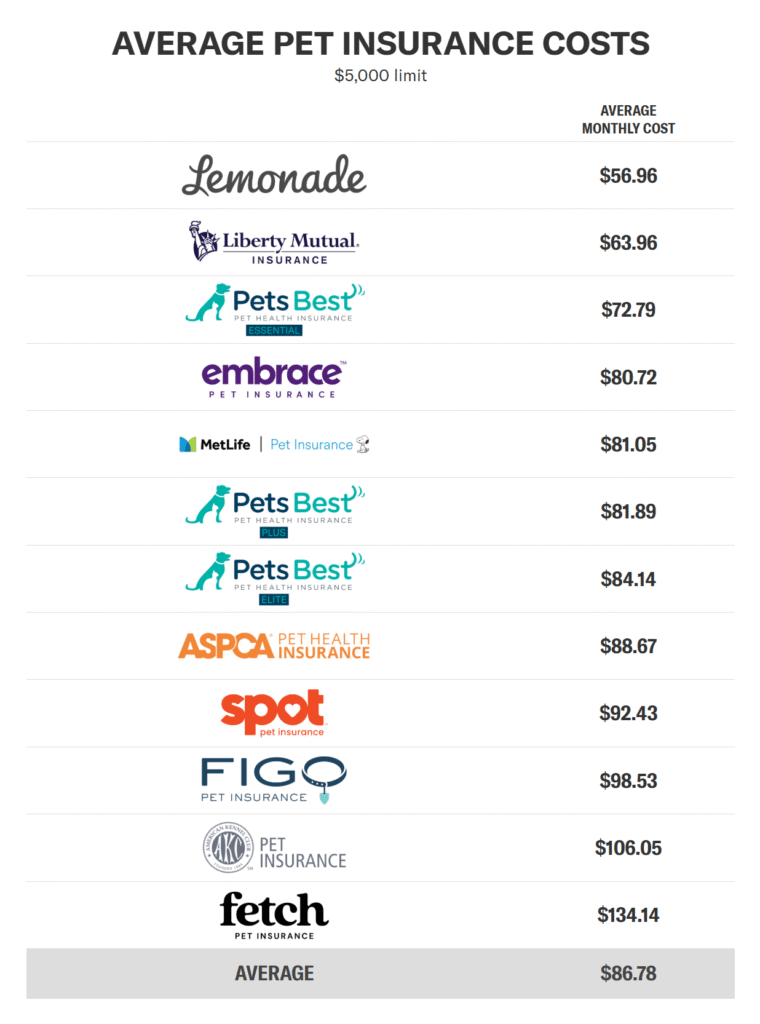

Figo’s premiums are generally at a medium to low level in the market, especially for users who want a high reimbursement ratio. Costco members can enjoy additional discounts, and multi-pet families also have a 5% discount. Despite the lack of simplified accident insurance solutions, Figo has improved the user experience through flexible plan design and digital services.

5. User feedback and potential shortcomings

- Advantages: No age limit, global coverage, fast claims, and convenient digital management.

- Disadvantages: It does not support direct payment to the veterinarian, and you need to pay first and then reimburse; there is no accident insurance plan, and some users may feel that the premium is too high.

- Disputes: Some users reported that the claim amount is too low, especially when dealing with common problems such as skin diseases; it is recommended to understand the terms in detail before taking out insurance.

Figo Pet Insurance, with its flexible protection plans and advanced digital services, is suitable for pet owners who pursue high reimbursement ratios and convenient claims processes. It performs well in terms of coverage and customer experience, but the lack of accident insurance and direct payment functions may make some users hesitate. Overall, Figo is a modern pet insurance option worth considering, especially for pet families who focus on combining technology and services.