In the United States, the federal income tax adopts a progressive tax rate system. The higher the income, the higher the applicable marginal tax rate. The tax brackets are adjusted according to inflation every year. The tax brackets in 2025 have changed compared to 2024, but the tax rates remain unchanged. This article will systematically introduce the tax rates, tax bracket ranges and calculation methods of the federal income tax in 2025 to help taxpayers understand the tax burden structure and plan their income and taxes reasonably.

1. Overview of the federal income tax rates in 2025

There are seven tax brackets for federal income tax in 2025, namely:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

These tax rates apply to different income ranges, and the tax bracket ranges applicable to taxpayers with different reporting identities are different.

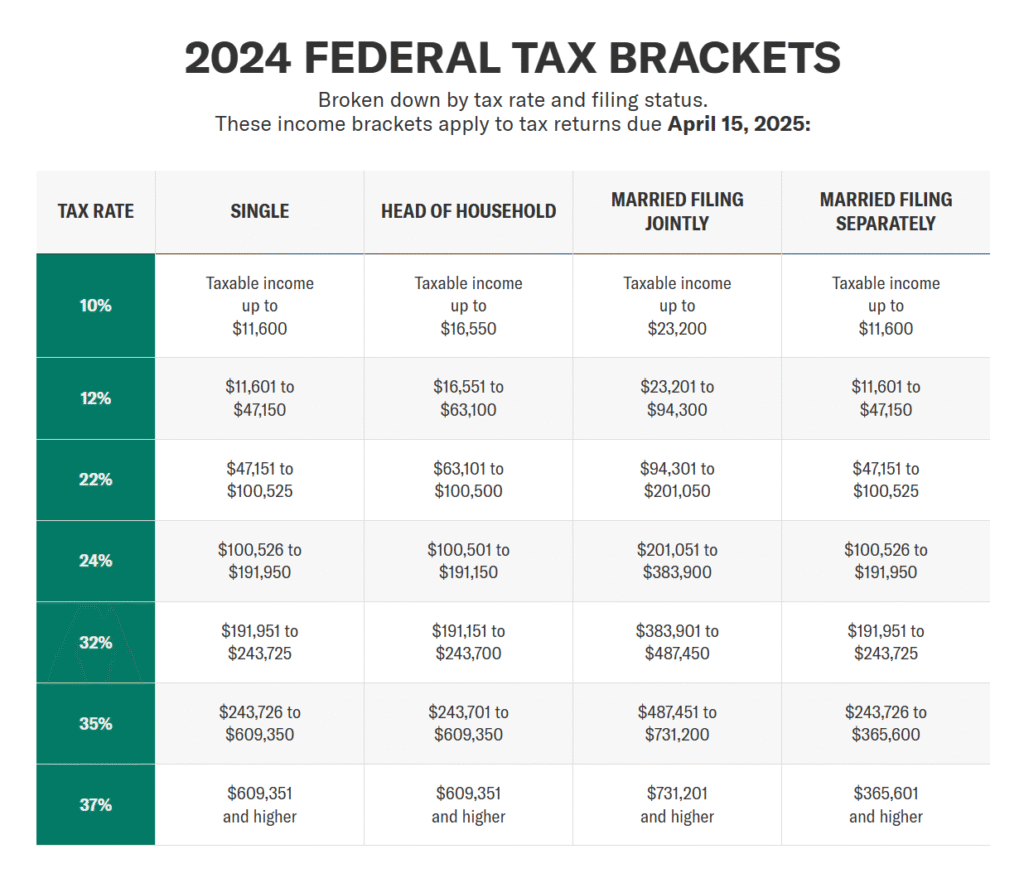

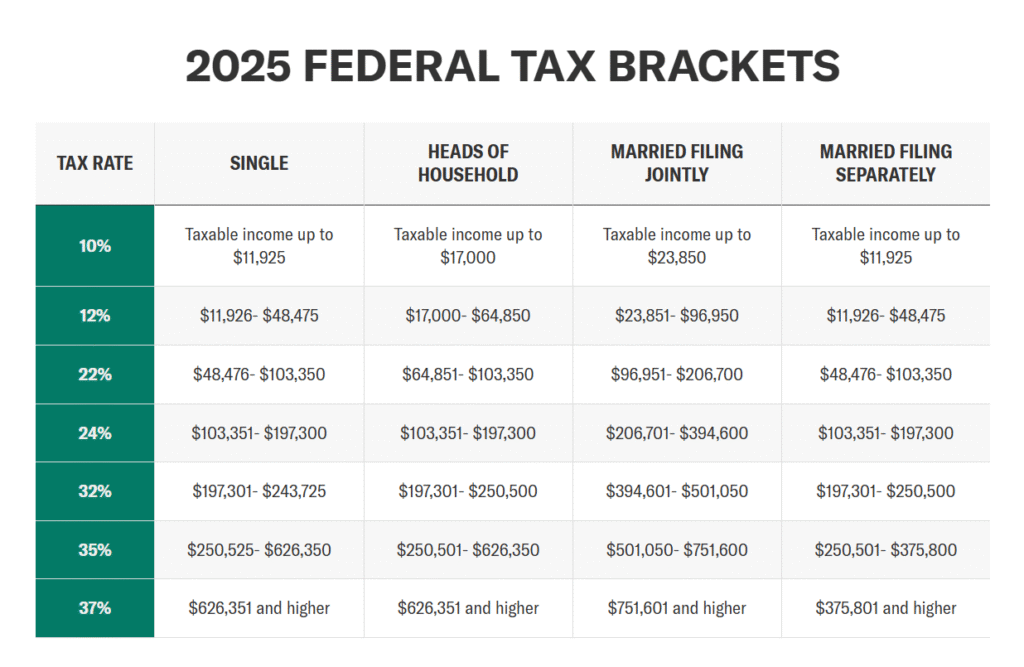

2. Tax brackets for each filing status in 2025

| Tax rate | Single filer | Head of household filer | Married couple filing jointly | Married couple filing separately |

|---|---|---|---|---|

| 10% | $0 – $11,925 | $0 – $17,000 | $0 – $23,850 | $0 – $11,925 |

| 12% | $11,926 – $48,475 | $17,001 – $64,850 | $23,851 – $96,950 | $11,926 – $48,475 |

| 22% | $48,476 – $103,350 | $64,851 – $103,350 | $96,951 – $206,700 | $48,476 – $103,350 |

| 24% | $103,351 – $197,300 | $103,351 – $197,300 | $206,701 – $394,600 | $103,351 – $197,300 |

| 32% | $197,301 – $250,525 | $197,301 – $250,500 | $394,601 – $501,050 | $197,301 – $250,525 |

| 35% | $250,526 – $626,350 | $250,501 – $626,350 | $501,051 – $751,600 | $250,526 – $375,800 |

| 37% | $626,351 and above | $626,351 and above | $751,601 and above | $375,801 and above |

3. How do tax brackets affect the amount of tax paid?

The progressive tax system in the United States means that different tax rates are applied to different income segments, rather than the highest tax rate for all income. For example, if a single taxpayer has a taxable income of $50,000 in 2025:

- The first $11,925 is taxed at 10%

- The portion from $11,926 to $48,475 is taxed at 12%

- The portion from $48,476 to $50,000 is taxed at 22%

The final tax amount is the accumulation of the tax amounts of each part, rather than a uniform tax on the entire income.

4. Marginal tax rate and effective tax rate

- Marginal tax rate: The tax rate levied on the last dollar of income, reflecting the tax burden level of additional income.

- Effective tax rate: The proportion of actual tax paid to total income, which is usually lower than the marginal tax rate, because the low-income portion is subject to a lower tax rate.

Understanding the difference between the two will help to reasonably plan income and deductions and optimize the tax burden.

5. The significance of tax bracket adjustment

Tax brackets are adjusted annually according to inflation to prevent “inflation-driven tax burden” (bracket creep) and ensure the stability of taxpayers’ actual tax burden. The adjustment of tax brackets in 2025 has slightly increased the income threshold, and taxpayers can enjoy a certain tax buffer.

6. Reasonable use of tax brackets to plan taxes

- Control taxable income: Reduce taxable income through retirement account contributions, tax credits, etc. to avoid entering a higher tax bracket.

- Use deductions and credits: standard deductions, mortgage interest deductions, education credits, etc. can effectively reduce taxable income.

- Diversify income sources: Rationally arrange income time and sources to optimize marginal tax rates.

The U.S. federal income tax rate will remain stable in 2025, and the tax brackets will be adjusted appropriately based on inflation. Understanding the tax bracket ranges for different reporting identities and the operation of the progressive tax system will help taxpayers accurately estimate their tax burden and develop effective tax planning strategies. Rational use of tax bracket rules and tax incentives is an important step in achieving wealth preservation and appreciation.