At a time when credit card interest rates continue to rise, many consumers are burdened with heavy credit card debt. Balance transfer credit cards, with their 0% or extremely low guide interest rates, provide valuable breathing space for repayers, helping them save interest and speed up repayment progress. This article will systematically sort out the best performing balance transfer credit cards on the market in 2025, analyze their advantages, applicable groups and usage strategies, and help you make wise choices and easily get rid of debt difficulties.

1. What is a balance transfer credit card?

Balance transfer credit cards allow users to transfer debt balances on other credit cards to new cards, usually accompanied by a period of 0% annual interest rate (APR) discount period. During this period, cardholders do not need to pay interest and can use more funds for principal repayment, thereby speeding up debt repayment. Balance transfer cards usually have low or no annual fees, but may charge a certain transfer fee.

2. Why choose a balance transfer credit card?

- Save high interest: The current average interest rate for credit cards is over 20%, and the 0% discount period for balance transfer cards can significantly reduce interest expenses.

- Accelerate the repayment process: The full amount of repayment during the interest-free period is included in the principal, shortening the repayment cycle.

- Simplify debt management: Consolidate multiple credit card debts, reduce repayment accounts, and reduce the risk of missed repayments.

- Improve credit score: Reasonable use can help reduce credit utilization and improve credit records.

3. Best balance transfer credit card recommendations for 2025

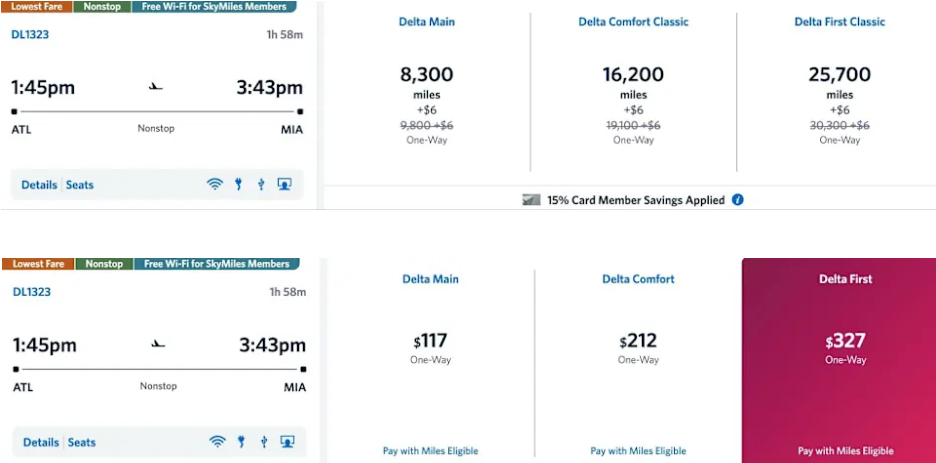

| Card name | 0% introductory period length | Annual fee | Balance transfer fee | Main features | Applicable groups |

|---|---|---|---|---|---|

| Wells Fargo Reflect® Card | 21 months | $0 | 5%, minimum $5 | The longest introductory period in the industry, including mobile phone protection, no rewards | Pursuing the longest interest-free period, focusing on debt repayment |

| Citi® Diamond Preferred® Card | 21 months | $0 | 3%-5% | Long-term interest-free, suitable for users with good credit | Users who need long-term interest-free repayment |

| Citi Double Cash® Card | 18 months | $0 | 3%-5% | Cash back, suitable for balancing rewards and repayment | Users who want to balance repayment and rewards |

| Discover it® Cash Back | 18 months | $0 | 3% | Rotating cashback categories, double cashback in the first year | Users who are good at planning their spending |

| Chase Freedom Unlimited® | 15 months | $0 | 3% | Cashback card, suitable for daily consumption | Those who need rewards and have a certain repayment plan |

4. How to choose a suitable balance transfer card?

- Pay attention to the length of the introductory period

The longer the 0% APR period, the more conducive it is to interest-free repayment. Wells Fargo Reflect and Citi Diamond Preferred offer a maximum interest-free period of 21 months. - Consider transfer fees

Most cards charge a fee ranging from 3% to 5%, and you need to calculate the balance between the fee and interest savings. - Assess your credit status

People with good credit are more likely to be approved for a long interest-free period card, and those with average credit can consider accepting a card with a shorter discount period. - Weigh rewards and repayment needs

If you want to get cash back rewards at the same time, Citi Double Cash and Discover it are good choices. - Avoid new debt

After the transfer, you should avoid new consumption on the old card to prevent the debt burden from increasing.

5. Balance transfer operation and precautions

- After applying for a new card and being approved, initiate a balance transfer request as soon as possible. The transfer usually takes 5-21 working days to complete.

- Maintain the minimum repayment on the old card to avoid overdue credit until the transfer is completed.

- Develop a reasonable repayment plan to ensure that the balance is paid off before the end of the discount period to avoid high interest.

- Pay attention to the standard interest rate and fees after the end of the discount period to prevent the burden of a sudden increase in interest rates.

6. Alternatives to balance transfer cards

- Personal loan: Fixed interest rate, suitable for debts with large amounts and clear repayment periods.

- Debt consolidation plan: Assist in managing multiple debts through professional institutions

- Credit Counseling Service: Get professional advice and develop a personalized repayment plan.

Balance transfer credit cards are like a sharp blade for debt management, which can cut off the shackles of high interest rates and win valuable time and financial space for repayers. Only by choosing the right card and planning your repayments properly can you truly achieve financial rebirth. As a financial guru said: “Debt is heavy, but reason and strategy are the key to seeing the light.” In 2025, take a solid step towards being debt-free with the help of these high-quality balance transfer credit cards.