Refinancing investment properties has become an effective means for many landlords to optimize their financial structure and improve cash flow. Unlike owner-occupied homes, refinancing investment properties faces more stringent requirements and complex processes. This article will systematically sort out the core reasons, steps and key points of refinancing investment properties to help you move forward steadily on the road of real estate investment.

1. Why choose to refinance investment properties?

There are various motivations for refinancing investment properties, mainly including:

- Lower interest rates and increase cash flow

When market interest rates fall or personal credit improves, refinancing can lock in lower interest rates, reduce monthly payments, and release more cash for property maintenance or other investments. - Adjust loan terms and optimize repayment strategies

By shortening the loan term, you can reduce interest expenses; or extend the term, reduce monthly payment pressure, and flexibly respond to funding needs. - Extract home equity and expand your investment portfolio

Cash loans (cash-out refinance) allow you to cash out the added value of your home, and the funds can be used to purchase more investment properties or other financial projects. - Increase property value and rental income

Use the withdrawn funds to renovate and upgrade, improve rental conditions, thereby increasing rental income and property market value. - Debt consolidation, simplify financial management

Combine multiple loans into a loan with a lower interest rate, reduce repayment burden, and optimize cash flow.

2. Basic requirements for investment property refinancing

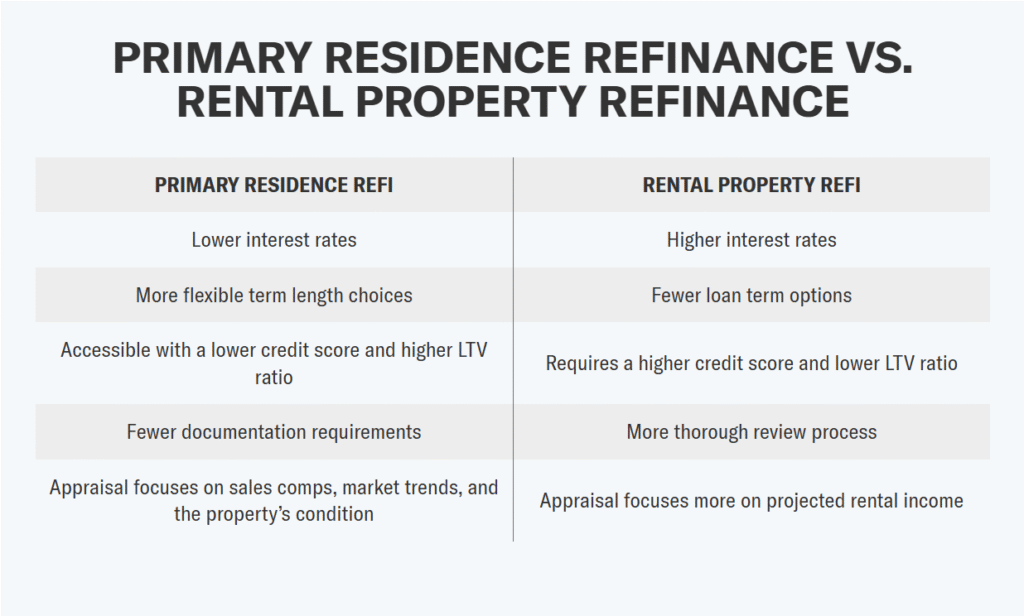

Investment property refinancing has a higher threshold than owner-occupied housing loans, and the main conditions include:

- Strict loan-to-value ratio (LTV) restrictions

Most lenders require LTV not to exceed 70% to 75%, which means at least 25% to 30% of the home equity. - Higher credit score requirements

Usually a minimum of 620 points is required. The better the credit, the more favorable the interest rate. - Debt-to-income ratio (DTI) control

DTI generally should not exceed 45% to 50%, ensuring that the borrower has sufficient income to cover the debt. - Proof of cash reserves

At least 6 months of mortgage payment reserves must be shown to cope with tenant vacancy or emergencies. - House valuation and rental verification

Lenders will require an assessment of the current value of the house and verify whether the rental income is reasonable to ensure that the loan risk is controllable.

3. Operational procedures for investment house refinancing

- Evaluation of net worth and qualifications

Calculate the current loan balance and the market value of the house to confirm whether the LTV and credit requirements are met. - Prepare necessary documents

Including proof of income (payroll, tax bill), proof of assets, house insurance policy, property documents, rental contract, etc. - Compare loan plans

Quotes from multiple lenders, pay attention to interest rates, loan terms, fees and services, and choose the best plan. - Lock in interest rates

After the loan application is approved, lock in the interest rate in time to prevent market fluctuations from increasing costs. - Accept loan review and house evaluation

The lender conducts a financial review and on-site house evaluation to confirm the house value and loan risk. - Complete loan settlement

Sign relevant documents, pay necessary handling fees, and the loan funds will be received.

4. Notes on refinancing investment properties

- Interest rates are usually higher than owner-occupied housing loans

Investment properties are riskier and loan interest rates are generally higher, so you need to carefully evaluate the costs and benefits. - Cash loans require reasonable planning

Although withdrawing net worth funds can expand investment, excessive debt may increase financial risks. - Maintain a good rental relationship

During the assessment period, you need to coordinate with the tenants to ensure smooth inspection of the house. - Prepare sufficient cash reserves

To cope with the financial pressure caused by tenant vacancy, repairs or market fluctuations. - Pay attention to market trends and policy changes

Changes in interest rates, taxes and loan policies will directly affect the costs and benefits of refinancing.

Investment property refinancing is a highly strategic financial operation that can not only optimize the loan structure and increase cash flow, but also provide financial support for investment expansion. The key to success lies in adequate preparation, accurate assessment of one’s own qualifications, rational selection of loan plans, and reasonable planning of fund use. Only in this way can one move forward steadily in the volatile real estate market and achieve steady growth of wealth.