Pets are important members of the family. In the face of sudden illness or accidents, comprehensive pet insurance has become a rational choice for many pet owners. As one of the earliest pet insurance brands in the United States, ASPCA Pet Insurance has won wide trust with its rich protection content and flexible plan design. This article will systematically sort out the core advantages, coverage, potential deficiencies and user experience of ASPCA Pet Insurance to help you choose the most suitable protection plan for your pet.

1. Introduction to ASPCA Pet Insurance

ASPCA Pet Insurance is authorized by the American Society for the Prevention of Cruelty to Animals (ASPCA), and the insurance business is underwritten by Crum & Forster Insurance Group. It dates back to 1997 and has more than 20 years of industry experience. Its services cover the United States and Canada, supporting pet owners to freely choose any veterinarian to see a doctor without network restrictions.

2. Protection Plan and Coverage

1. Complete Coverage

ASPCA’s core product is the “Complete Coverage Plan”, which is applicable to cats and dogs of all ages, with no maximum age limit. The plan covers a wide range of areas, including:

- Diagnosis and treatment, hospitalization, and surgery for illness and accidents

- Treatment of major diseases such as cancer and diabetes

- Prescription drugs, special prescription foods, and nutritional supplements

- Genetic and congenital diseases

- Microchip implants

- Alternative therapies, such as acupuncture and chiropractic

- Behavioral therapy

- Imaging examinations (MRI, ultrasound, X-ray)

- Stem cell therapy

- Hospice and euthanasia-related expenses

Many items in this series of protections are often charged extra or not included in other insurance companies, reflecting the comprehensiveness of the ASPCA plan.

2. Accident-Only Coverage

The plan only covers medical expenses related to accidental injuries, such as fractures, bites, and ligament tears, and does not include disease treatment. Suitable for families with limited budgets or pets in good health.

3. Horse Insurance Plan

For horses, the ASPCA provides insurance covering accidents, illnesses and specific conditions (such as colic), including tooth extraction, hospitalization, surgery, poison consultation and euthanasia.

3. Advantages and highlights

- No age limit: Pets can be insured regardless of age, and will not be cancelled due to age.

- Prescription food and behavioral therapy coverage: These are additional items in most competing products, but the ASPCA plan already includes them to meet the diverse health needs of pets.

- Multi-pet discount: Families with multiple pets can enjoy premium discounts to reduce financial pressure.

- No extended waiting period: There is no additional waiting period for orthopedic diseases, and the coverage is more timely.

- 24/7 veterinary consultation service: Policy holders can visit the ASPCA’s veterinary hotline at any time to get professional health advice.

- Covering burial and cremation expenses: Provides humane protection for pets at the end of their lives.

- 30-day money-back guarantee: New customers can unconditionally cancel their insurance within 30 days, reducing the risk of purchase.

4. Limitations to note

- Long waiting time for claims: Claims processing usually takes nearly a month, which is slightly slower than some competitors.

- Low annual compensation limit: The annual maximum compensation amount of some plans is lower than the market average, which may limit high medical needs.

- Limited quotation for elderly pets: Pets aged 18 and above cannot directly obtain quotes online and need to contact customer service.

- Customer service response time: Some users reported that the customer service waiting time was long, affecting the experience.

- Limited dental coverage: Dental disease coverage is not as comprehensive as some competitors.

5. Price and flexibility

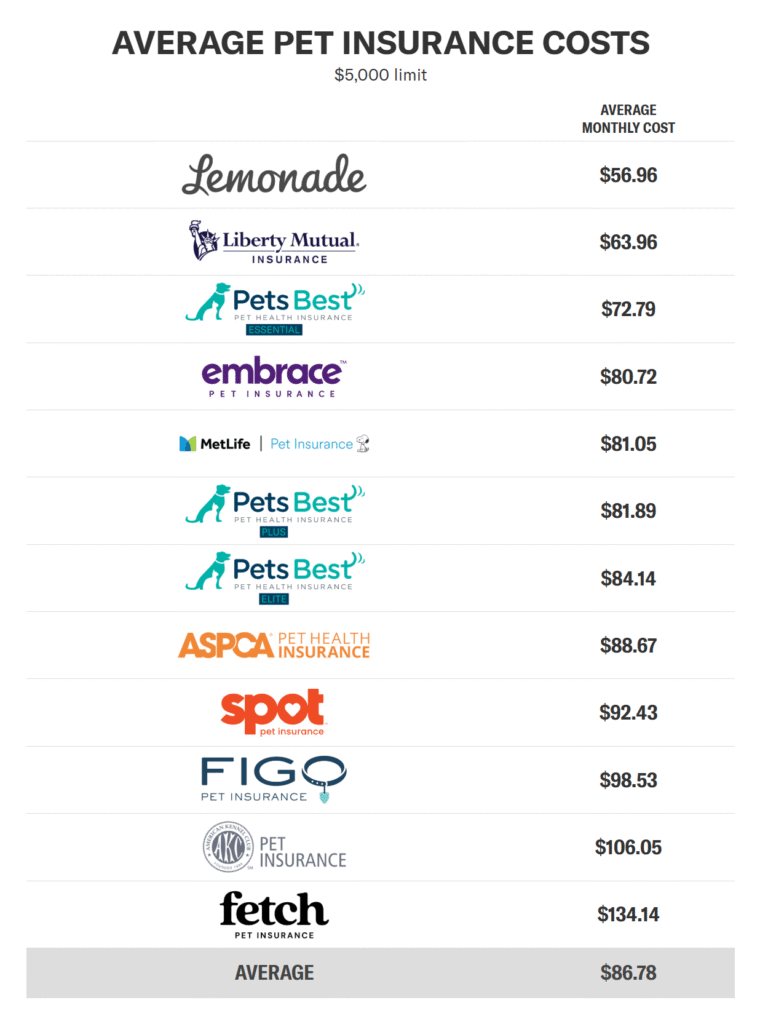

ASPCA offers multiple annual compensation limits (such as $5,000, $10,000, etc.), adjustable deductibles and reimbursement ratios to meet different budgets and protection needs. Multi-pet discounts and no age restrictions make it particularly attractive to multi-pet families and elderly pets.

6. User Experience and Service Quality

ASPCA Pet Insurance has received an “excellent” rating on both TrustPilot and ConsumerAffairs, and users generally recognize its rich coverage and transparent claims. The official website is easy to operate and supports any veterinary consultation nationwide. The 24-hour veterinary hotline has become a trusted consultation channel for users. Although the claim cycle is long and the customer service response needs to be improved, the overall service is still competitive.

ASPCA Pet Insurance has become a solid force in the field of pet health protection with its long history, comprehensive coverage and flexible plan design. The advantages of no age restrictions and covering a variety of special medical projects make it stand out among many pet insurances. Despite the shortcomings of a long claim cycle and insufficient service experience, its overall value is still worth recommending, especially for those who focus on comprehensive medical protection and multi-pet families.