Pets are not only our companions, but also family members. Choosing the right insurance plan for them can not only protect the health of pets, but also reduce the financial burden on owners. This article will comprehensively analyze the advantages and disadvantages of Embrace Pet Insurance to help pet owners make wise choices.

1. Overview of Embrace Pet Insurance

Embrace was founded in 2006 and quickly won market recognition with its flexible customized solutions and rich coverage. It not only cooperates with well-known insurance companies such as Allstate and GEICO, but also provides services to more than 900,000 pets. Its core features include:

- Wide coverage: Covers accidents, disease treatment and optional routine care (Wellness) plans.

- Highly customized: Users can choose a reimbursement ratio ranging from 70% to 90%, and the annual compensation limit ranges from US$5,000 to US$30,000.

- Multiple discounts: Including multi-pet discounts, healthy pet discounts and military discounts, which can save up to 25% of premiums.

- Global Coverage: When pet owners travel abroad, they can enjoy claims from any licensed veterinarian in the world for up to 6 months.

2. Detailed explanation of coverage

1. Accident and disease coverage

Embrace’s core plan covers medical expenses incurred by pets due to accidents or diseases, including:

- Emergency treatment and specialist treatment (such as oncology, internal medicine)

- Diagnostic testing

- Surgery and hospitalization

- Alternative therapies, such as acupuncture, physical therapy, laser therapy and chiropractic

- Prostheses and mobility aids

- Prescription drugs (prescription drug coverage must be purchased separately)

In addition, Embrace provides coverage for “curable” pre-existing conditions, provided that the pet is symptom-free and has no treatment record for 12 consecutive months.

2. Wellness Plan

As an additional option, the Wellness Plan covers:

- Vaccinations

- Physical examinations and preventive care

- Spaying and neutering, microchip implantation

- Grooming, nutritional supplements and training courses

The plan adopts an annual total limit (up to $700) instead of a single service limit, which is more flexible.

3. Advantages

- Flexible customization: adjustable deductibles (from $200 to $1,000), and a “decreasing deductible” is set. The amount of out-of-pocket expenses can be reduced year by year if there are no claims in a row.

- Multiple discounts: including a 5%-10% discount for healthy pets and a 10% discount for multiple pets, which significantly reduces premium expenses.

- Quick claims: the waiting period for accident claims is only 2 days, the waiting period for disease claims is 48 hours, and the claim processing cycle is 10-15 working days. Checks and electronic transfers are supported.

- Long coverage age: Pets under 15 years old can enjoy full insurance, and pets 15 years and above can purchase accident insurance.

- 24/7 veterinary consultation hotline: Answer pet health questions at any time to improve the service experience.

4. Restrictions to note

- Some expenses need to be purchased separately: The basic plan does not include veterinary physical examination fees and prescription drug fees, which need to be purchased separately.

- Prescription food and supplements are not covered: This is a shortcoming for pet owners with certain special dietary needs.

- Long waiting period for orthopedic diseases: The waiting period for canine orthopedic diseases is 6 months, although it can be shortened through additional payments.

- Limited protection for elderly pets: Pets 15 years and above can only purchase accident insurance, and some areas (such as California) have stricter restrictions on elderly pets.

- Dental disease compensation limit: The maximum compensation for dental diseases is $1,000, which is lower than some competitors.

5. Price and Cost-effectiveness

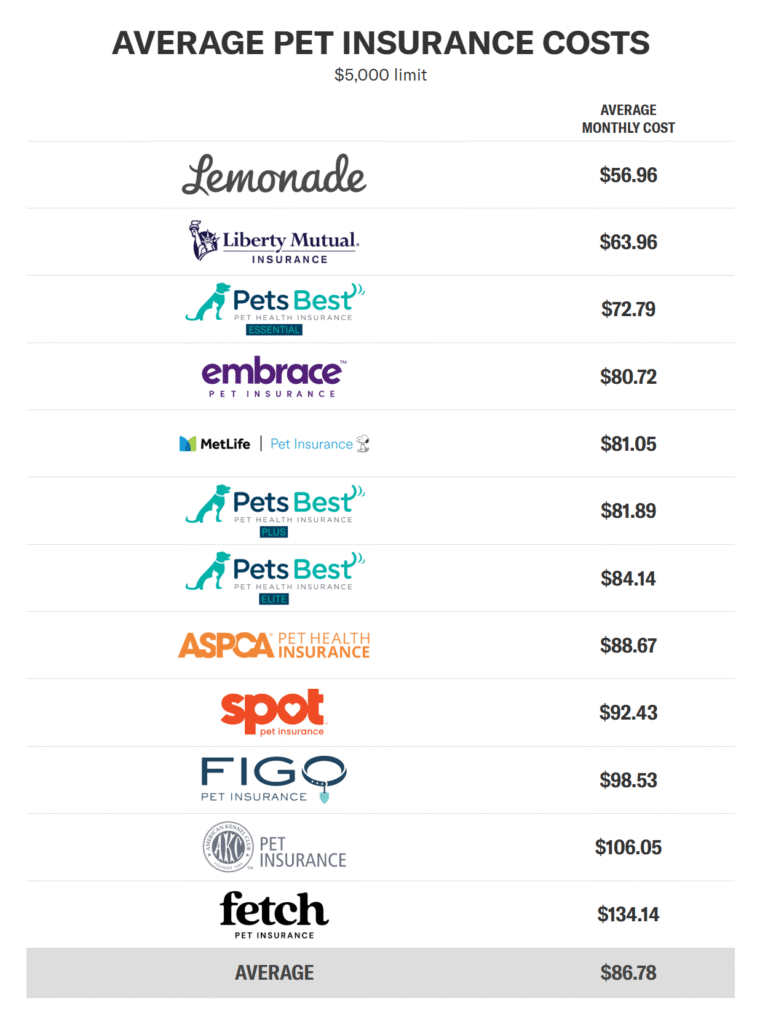

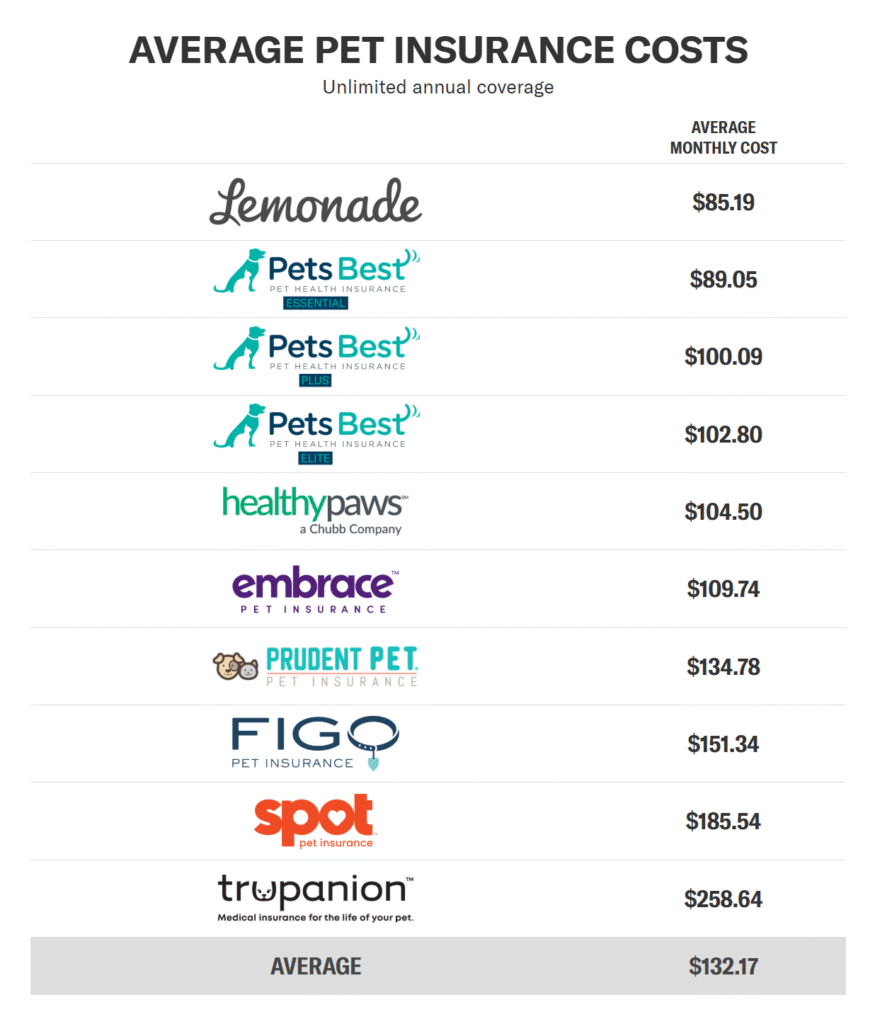

Embrace’s premiums are generally below the market average, but cat insurance costs are relatively high. Users can get greater discounts by making reasonable use of discounts for multiple pets and healthy pets. It is recommended to choose a basic plan with a high deductible and a low limit of compensation, combined with an advanced Wellness supplementary plan, based on the health status and budget of the pet, to achieve a balance between protection and cost.

6. User Experience and Service

Embrace’s official website has a simple design, and the quotation and claims process is convenient. Customer service supports phone and online chat, and responds promptly. Its mobile application has received good reviews on both iOS and Android platforms, making it convenient to manage policies and submit claims at any time.

Embrace pet insurance has become the preferred choice for pet owners who pursue personalized protection with its flexible customization options, diverse discount incentives and rich protection content. Although there are some limitations, such as insufficient protection for elderly pets and some fees that need to be purchased separately, its overall performance is stable, especially suitable for long-term health management and multi-pet families.

Choosing Embrace not only provides comprehensive medical protection for your pet, but also brings peace of mind and trust to yourself.