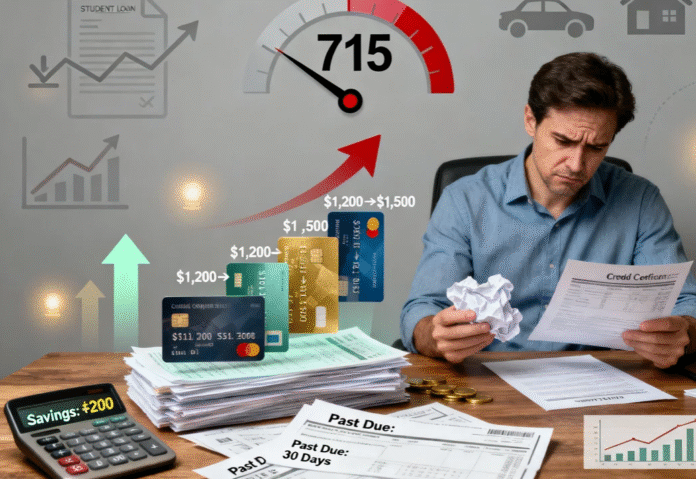

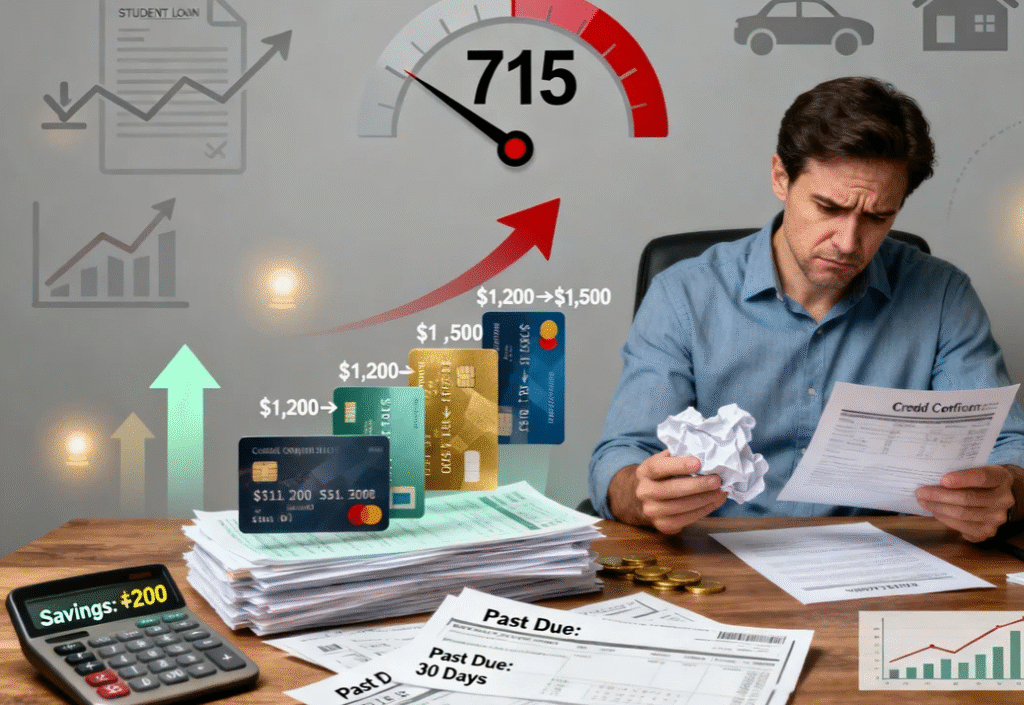

After more than a decade of steady growth, the national average credit score has dipped for the second consecutive year, according to a new FICO report. The average score now stands at 715, down from 717 in 2024 and 718 in 2023. (FICO scores range from 300 to 850.)

Rising interest rates and inflationary pressures have strained household finances, pushing many Americans deeper into debt. As credit card balances climb and missed payments become more common, the downward trend in credit scores is becoming evident.

“I’m not surprised credit scores are slipping,” said Matt Schulz, chief credit analyst at LendingTree. “With persistent inflation, high interest rates, a challenging job market, and economic uncertainty, many Americans are making tough financial choices.”

Student Loan Delinquencies Drive Score Drops

One major factor behind the decline is the resumption of federal student loan delinquency reporting. During the pandemic, forbearance programs temporarily marked federal student debt as current, boosting median credit scores for borrowers by 11 points between 2019 and 2020. But when the relief period ended on September 30, 2024, past-due accounts were reported again, leading to a sharp rise in severe delinquencies.

Tommy Lee, FICO’s senior director of scores and predictive analytics, warned that student loan delinquencies could continue rising as access to income-driven repayment plans changes.

Not Everyone Is Feeling the Pinch

While some borrowers face financial stress, others are benefiting from gains in the stock and housing markets. FICO notes a widening gap, with more consumers falling into either the highest or lowest credit score ranges.

“Despite the average score decline, some consumers have grown wealthier due to stock market gains and appreciating real estate,” Lee said.

Tips for Boosting Your Credit Score

Fortunately, credit scores are dynamic, and consumers can take action to improve them quickly. Experts recommend paying bills on time, only applying for new credit when necessary, and keeping credit utilization below 30%.

Lifting a credit score from the fair range (580–669) to very good (740–799) could save more than $39,000 over a lifetime, according to LendingTree — mostly through lower mortgage costs, followed by better rates on credit cards, auto loans, and personal loans.

“There’s very little more expensive than bad credit,” Schulz said. “It can cost tens of thousands of dollars over time in fees and interest.”