Amid the increasing integration of digital assets and traditional finance, the cooperation between Coinbase and American Express is undoubtedly one of the most eye-catching events in 2025. The “Coinbase One Card” credit card jointly launched by the two parties seamlessly integrates the Bitcoin reward mechanism into daily consumption, opening up a new passive income model for cryptocurrency enthusiasts. This article will deeply analyze the characteristics and advantages of this revolutionary credit card and its profound impact on the future financial landscape.

1. Coinbase One Card: A bridge between digital assets and daily consumption

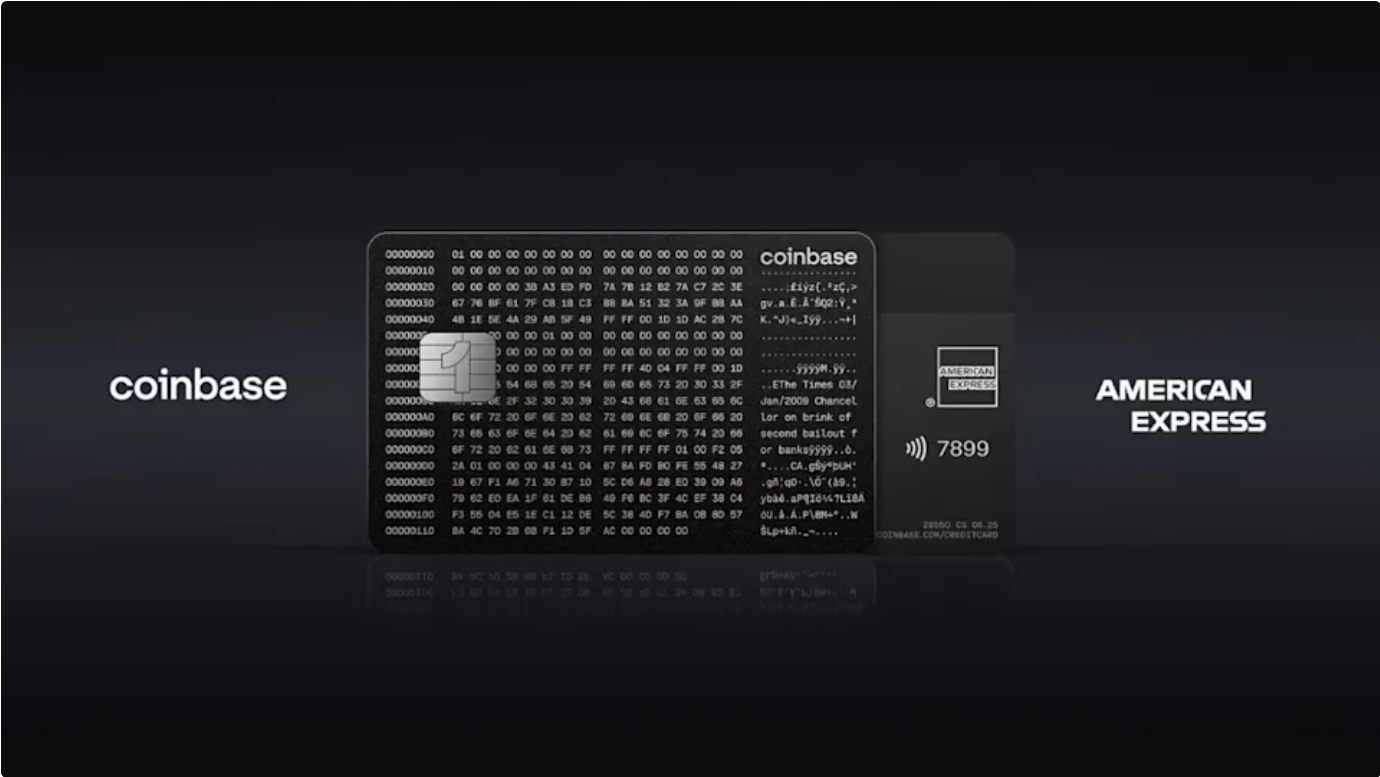

Coinbase One Card is the first Bitcoin rewards credit card launched by Coinbase, supported by the American Express network and issued by First Electronic Bank. This card aims to integrate the acquisition of cryptocurrency into users’ daily spending, so that every consumption can be converted into the accumulation of Bitcoin assets[1][3][4].

2. Core highlights and reward mechanism

1. Up to 4% Bitcoin reward

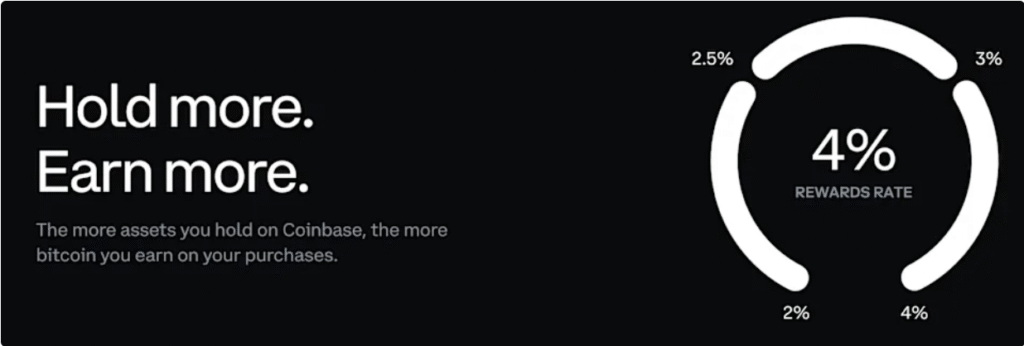

The most eye-catching feature of Coinbase One Card is its up to 4% Bitcoin return ratio. The specific reward levels are as follows:

- Basic rebate: All purchases can get at least 2% Bitcoin rebate[2][5].

- Step-by-step increase: Depending on the amount of assets held by the user on the Coinbase platform, the rebate ratio can be increased to 2.5%, 3% or even a maximum of 4%[1][2].

This means that users can continue to accumulate Bitcoin through daily shopping without actively trading, providing a new way to popularize cryptocurrency[3][4][6].

2. Member-exclusive benefits

The card is designed for Coinbase One members, with an annual membership fee of $49.99. In addition to credit card benefits, members can also enjoy:

- Transaction fee reduction: The first $500 of transactions per month are waived[2][8].

- High-yield deposits: USDC deposits can enjoy an annualized rate of return (APY) of up to 4.5%[2][8].

- Additional staking rewards: Assets such as ETH and SOL can get an additional 5% staking reward[2][8].

- Base network gas fee subsidy: A monthly $10 subsidy for Base network transactions[8].

These additional benefits further enhance the overall value of Coinbase One membership[2][5].

3. Excellent design and traditional financial protection

- Metal card design: The card is made of metal and engraved with the text of the Bitcoin Genesis Block, highlighting its deep connection with the origin of Bitcoin and its unique digital aesthetics[4][5].

- Amex network advantage: With the help of the American Express network, Coinbase One Card holders can enjoy a number of traditional credit card benefits such as travel protection, extended warranty, and shopping protection, ensuring convenience and security of use[5][8].

3. Impact on the cryptocurrency market

The launch of Coinbase One Card marks that the cryptocurrency market is actively seeking recovery and moving closer to the mainstream financial system after experiencing the “crypto winter” in 2022. This card is not only another attempt by Coinbase after its Visa debit card, but also represents the recognition and layout of traditional financial giants such as American Express in the Web3 field[2][7].

It provides a low-threshold entry way for cryptocurrency novices to passively accumulate Bitcoin through daily consumption, thereby lowering the threshold for participating in the digital asset market. At the same time, for veteran cryptocurrency investors, it provides an efficient Bitcoin accumulation tool to integrate the “HODL” concept into life[3][5][6].

4. Looking to the future

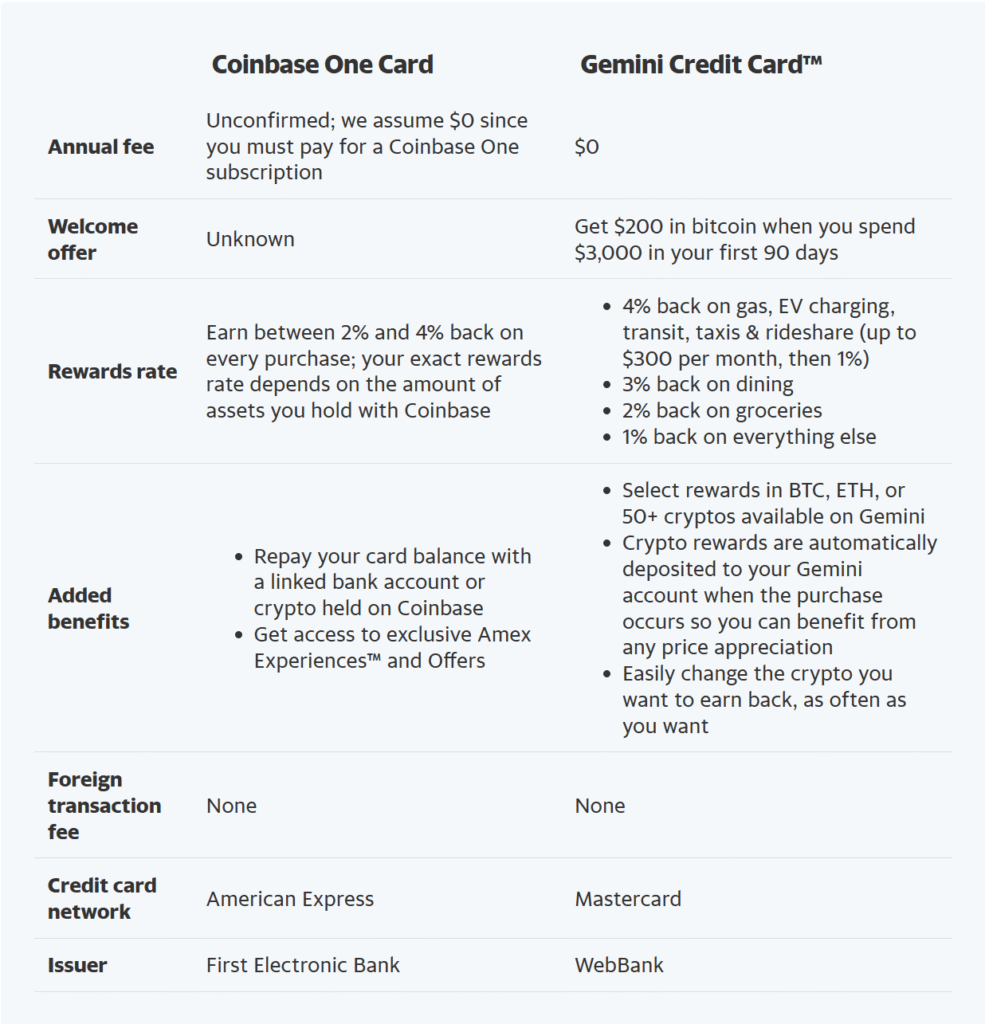

Coinbase One Card is scheduled to be officially launched to US users in the fall of 2025, and waiting list registration is currently open[1][8]. Although the specific asset holding threshold has not yet been announced, its high 4% Bitcoin return rate undoubtedly makes it a leader in the cryptocurrency credit card market, and may even surpass existing competitors such as Gemini Credit Card[1][5].

As an industry observer said: “Every attempt to integrate emerging technologies into daily life is a step forward in the progress of human civilization. The launch of Coinbase One Card is another milestone in the inclusiveness of digital finance.” It indicates that in the future, our wallets will not only contain legal tender, but also vibrant digital assets.

“`

[1] https://finance.yahoo.com/personal-finance/credit-cards/article/coinbase-reveals-new-bitcoin-credit-card-185439289.html

[2] https://www.nerdwallet.com/article/credit-cards/coinbase-to-launch-crypto-earning-credit-card

[3] https://web.ourcryptotalk.com/news/coinbase-one-credit-card-bitcoin-rewards-2025

[4] https://bitcoinnews.com/adoption/coinbase-one-card-bitcoin-rewards/

[5] https://www.blockchainmagazine.net/one-card-coinbase-and-amex/

[6] https://swipefile.com/coinbase-one-credit-card-4-bitcoin-back

[7] https://pintu.co.id/en/news/167827-coinbase-launches-coinbase-one-card-at-crypto-summit-2025/amp

[8] https://www.credit-land.com/news/coinbase-and-american-express-to-launch-new-coinbase-one-card.php

[9] https://www.coinbase.com/creditcard

[10] https://www.coinbase.com/blog/earn-up-to-4-percent-bitcoin-back-on-every-purchase-with-the-new-coinbase-one-card