The Earned Income Tax Credit (EITC) is a refundable tax benefit for low- and middle-income workers that aims to reduce tax burdens and encourage employment. It not only reduces the amount of tax payable, but also provides a tax refund if the credit exceeds the tax. This article will systematically introduce the eligibility criteria, credit amount, application process, and precautions for the 2025 EITC to help you make the most of this important tax benefit.

1. What is the Earned Income Tax Credit (EITC)?

The EITC is a refundable tax credit for eligible workers. It provides different amounts of tax credits based on the taxpayer’s income, filing status, and number of dependent children. Even if you don’t have children, you may be eligible, and the credit amount increases with the number of children.

2. Eligibility Requirements

- Income Limits

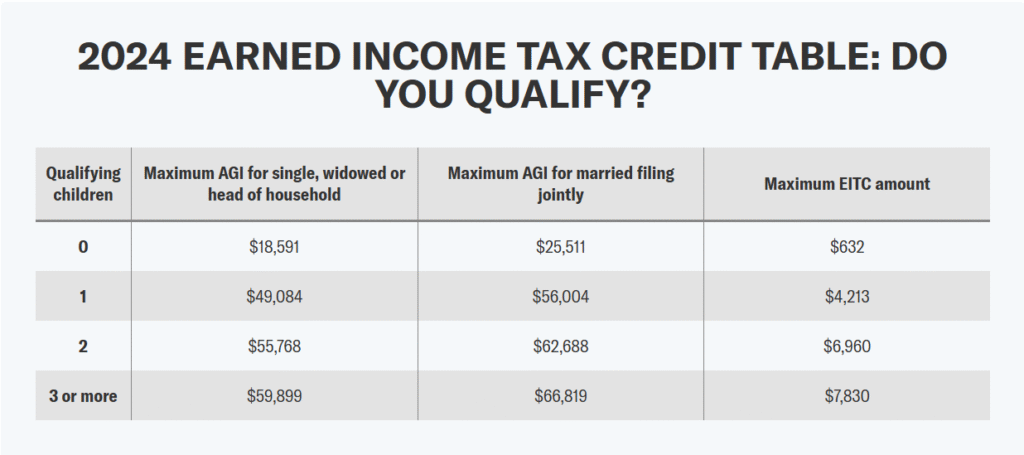

In 2025, the taxpayer’s adjusted gross income (AGI) and earned income must be less than the following limits, depending on the filing status and the number of children. - Age Limit

Childless filers must be at least 25 years old and no older than 64 years old. When filing a joint return, at least one spouse must meet the age requirement. - Investment Income Limit

Investment income cannot exceed $11,950 (2025 standards). - Residence Requirements

The taxpayer and children must have lived in the United States for more than half a year and cannot be claimed as dependents by others. - Special Circumstances

There are special rules for separated but not divorced people, military personnel, clergy, and people with disabilities.

3. EITC credit amount and income threshold in 2025

| Number of children | Maximum credit amount | Maximum income for singles/heads of households | Maximum income for couples |

|---|---|---|---|

| No children | $649 | $19,104 | $26,214 |

| 1 child | $4,328 | $50,434 | $57,554 |

| 2 children | $7,152 | $57,310 | $64,430 |

| 3 or more children | $8,046 | $61,555 | $68,675 |

If the income exceeds the above limit, the credit will be gradually reduced until it is completely invalid.

4. Eligible children criteria

- Biological children, adopted children, stepchildren, foster children or grandchildren.

- Brothers and sisters and their children may also qualify.

- Age limit: under 19 years old, or under 24 years old for full-time students, or no age limit for permanent disabilities.

- Must live with the taxpayer for more than half a year.

5. EITC eligibility for childless filers

Childless taxpayers must meet the following requirements:

- Aged between 25 and 64.

- Lived in the United States for more than half a year.

- Not claimed as a dependent by others.

- Have earned income and the income meets the limit.

6. How to claim EITC?

- Claim on the federal tax return (Form 1040 or 1040-SR).

- Those with eligible children need to fill out Schedule EIC and provide child information.

- Use qualified tax software or seek professional help to ensure correct reporting.

- IRS Free File is a convenience for those who meet the requirements.

7. Refund issuance time and precautions

- EITC tax refunds are usually delayed, and IRS law stipulates that they will be issued as early as mid-February.

- Electronic filing and direct deposit can speed up the refund.

- Incorrect filing or incomplete information will cause refund delays.

- You can check the refund status in real time through the IRS “Where’s My Refund?” tool.

The Earned Income Tax Credit (EITC) is an important tax benefit for low-income and middle-income workers, which can significantly reduce taxes and increase tax refunds. Understanding the eligibility conditions, credit amount and filing process can help taxpayers maximize their benefits. It is recommended to combine professional tax resources to ensure accurate filing and make full use of the financial support brought by EITC.